What are Dividend Aristocrats?

A dividend aristocrat is a company that has raised its dividend for at least 25 consecutive years. There are Dividend Aristocrat Stocks worldwide at January 2026 139 .

Dividend Aristocrats -

What are the requirements?

The prerequisite for being called a Dividend Aristocrat is 25 consecutive years of dividend increases.

The USA has the highest number of dividend stocks that meet this requirement. In the USA there are 114 Dividend Aristocrats, while there are no Dividend Aristocrats for German Stocks.

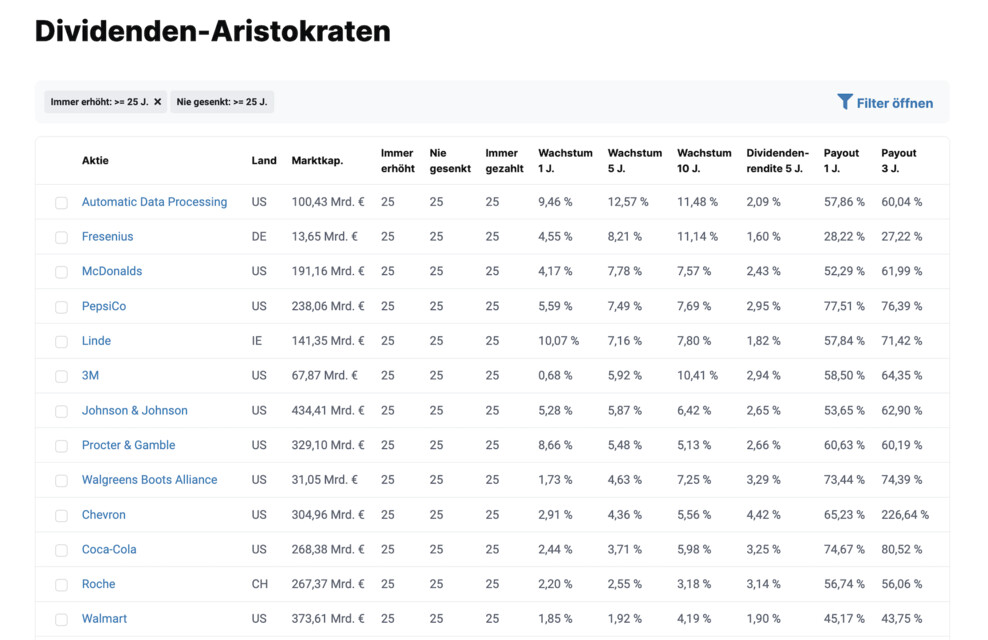

List of 139 Dividend Aristocrats in the January 2026

The table shows the best Dividend Aristocrats worldwide. The basic requirement of 25 consecutive years of dividend increases is met by 139 stocks. The sorting is based on the current dividend yield.

| Stock | Div. Score | Market Cap. | Always increased | Never lowered | Always paid | Growth 1Y |

Growth 5Y |

Growth 10Y |

Div. Yield current Current Dividend Yield |

Div. return 5Y Dividend Yield 5Y |

Payout 3Y |

|---|

Why are Dividend Aristocrats so popular with investors?

Dividend Aristocrats are particularly popular with long-term investors as they promise continuous and rising dividends. The longer a company pays and increases a dividend , the more investors expect rising dividends in the future. These stocks are rare on the stock market. What is particularly impressive is that these companies have survived several economic cycles and two major crises (new economy & financial crisis).

However, past dividend performance should not be the deciding factor for a purchase. Other criteria, such as those of the dividend needle, should also be taken into account.

Dividend Aristocrats Rating - How do I find the best Dividend Aristocrats?

To find the best Dividend Aristocrats, you should look at other key figures in addition to 25 consecutive years of dividend increases. Here you will find a simple dividend stock checklist on how to proceed as an investor:

Dividend growth

Dividend growth

Payout ratio

Payout ratio

Dividend yield

Dividend yield

Dividend growth

Payout ratio

Dividend yield

Use our handy features to find the best dividend-paying stocks.

Implementing your dividend strategy is more efficient and more promising with StocksGuide.

Strategy with Dividend Aristocrats

You can pursue different strategies when investing in Dividend Aristocrats. There are essentially three dividend aristocrat strategies:

High dividend yields

Dividend Aristocrat Stocks are selected on the basis of their high dividend yield. The dividend yield expresses the ratio of the dividend to the stock price as a percentage.

Advantage: High dividends. However, a company is not obliged to pay a dividend (no interest). Therefore, you may not receive this return in the future, as the dividend may be canceled or reduced.

Caution: A high dividend yield does not always indicate an attractive investment. A high dividend yield is often linked to a sharp fall in the stock price. This in turn is often the result of poor future prospects for the company.

Tip: To get a better idea of the dividend yield, you should consider at least two periods: the current period and the average of the last 5 years.

High dividend growth

Dividend Aristocrat Stocks are selected on the basis of high dividend growth. High dividend growth can be a significant lever for your return.

Advantage: Assuming a company pays a dividend of 1 euro per share and increases the dividend by 15 % for 5 consecutive years. After 5 years, you will already receive 2 euros per share, i.e. twice as much as at the beginning!

Disadvantage: The company should not overreach itself and promise dividends that rise too quickly. In the future, it may not be possible to maintain this pace and the company may lose its status as a dividend aristocrat.

Tip: In order to better classify dividend growth, you should consider at least three time periods: 1 year, 5 years and 10 years.

Future Dividend Aristocrats

The selection of future dividend aristocrat stocks is based on previous dividend increases. With the StocksGuide screener or the dividend needle tables, you can easily find stocks with 20 years of dividend increases. This means that the company only needs 5 more years of rising dividends to achieve dividend aristocrat status.

Advantage: Dividend aristocrat stocks are very popular. With this strategy, you can find the most reliable future dividend payers before they are on the radar of other investors.

Disadvantage: The elite threshold of 25 years may not be reached and the company will not become a dividend aristocrat.

Tip: Keep an eye on the payout or payout ratio. This way you can reduce the risk that the company will not manage to increase the dividend for 25 years in a row.

Dividend continuity is important when selecting dividend stocks.

This refers to the number of consecutive years in which the company has not reduced its dividend. As the minimum requirement for Dividend Aristocrats is 25 consecutive dividend increases, this requirement is always met by Dividend Aristocrats.

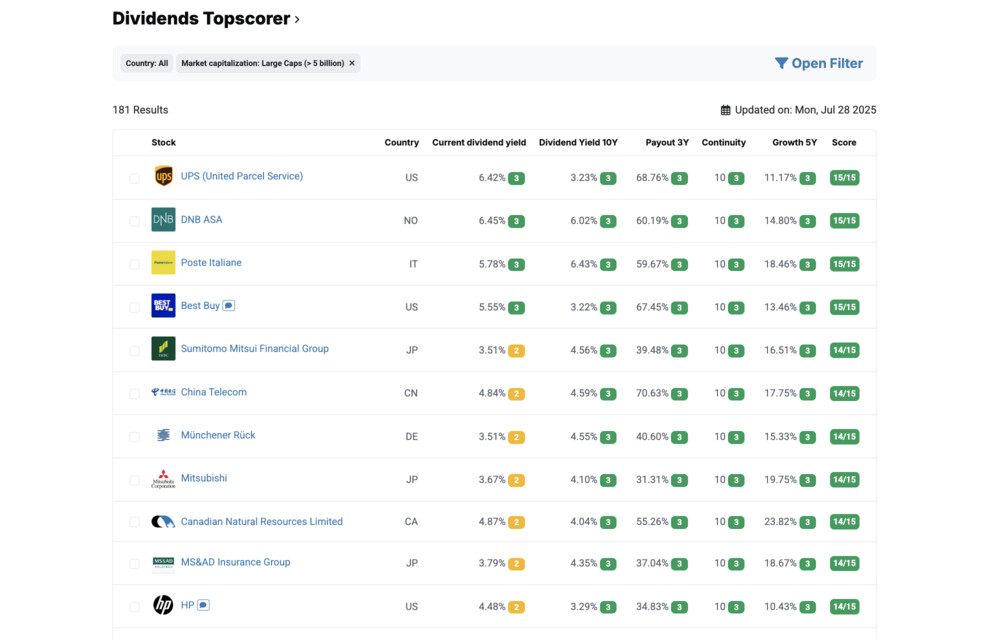

Top scorer analyses

Our experts take a closer look at current top scorers according to the Levermann, High Growth Investing and Dividend strategies.

Register now for free to access more top scorer analyses.

Get Started for Free TodayDividend Aristocrats - as ETF or Stock?

A portfolio with Dividend Aristocrats can be built up with individual stocks or with Dividend Aristocrat ETFs. The main advantage of investing in individual Dividend Aristocrat Stocks is the greater flexibility of your portfolio. You can decide for yourself which criteria are important to you and which stocks you want to buy for your portfolio. A so-called "Dividend Aristocrats ETF" defines the strategy. Often the ETFs already deviate from the minimum requirement - 25 dividend increases in a row!

What ETFs are available?

There are several dividend aristocrat exchange traded funds that you can buy. Below you will find three ETFs as examples:

- SPDR S&P U.S. Dividend Aristocrats ETF (WKN: A1JKS0)

- SPDR S&P Euro Dividend Aristocrats UCITS ETF (WKN: A1JT1B)

- SPDR S&P Pan-Asia Dividend Aristocrats ETF (WKN: A1T8GC)

On closer inspection, dividend aristocrat ETFs or funds are often not what you would expect. It is therefore a good idea to select the stocks yourself and start stock-picking the best Dividend Aristocrats. The first ETF - SPDR S&P U.S. Dividend Aristocrats ETF - already lowers the minimum requirement of 25 consecutive dividend increases to 20. The European counterpart - SPDR S&P Euro Dividend Aristocrats UCITS ETF - lowers the threshold to 10 years. The third ETF - SPDR S&P Pan-Asia Dividend Aristocrats ETF - lowers the minimum requirement to 7 years!

You will find

- The Best German Dividend Stocks

- The Best US Dividend Stocks

- Dividend Stocks Worldwide

- Dividend Calendar

everything at a glance.

We thus offer the most comprehensive dividend data for a valuation of the top dividend stocks.

Advantages and disadvantages of Dividend Aristocrats

A portfolio with Dividend Aristocrats has advantages and disadvantages. Below you can find out the three biggest advantages and disadvantages of investing according to a dividend aristocrat strategy:

Advantages

Robust business model

Stocks that have increased their dividends every year for at least 25 years have a very robust business model. In addition, they usually have solid finances and stable, predictable earnings.

Regular distributions

Most Dividend Aristocrats come from the USA. As most dividend stocks there pay out their dividends quarterly, you can look forward to regular dividends as a long-term investor.

Lower fluctuations

Advantages 1 & 2 generally mean that the price of a dividend aristocrat is less susceptible to fluctuations than other stocks.

Disadvantages

Deceptive security

Past performance says nothing about future performance. Even a dividend aristocrat may fail to make dividend payments. The future viability of the business model should always be reviewed.

Low growth

In the long term, the return on the stock market for dividend stocks is made up of price gains and dividends. Dividend Aristocrats often grow slowly. You should therefore not assume high price gains when buying a dividend aristocrat.

Lower fluctuations

Lower fluctuations can be both an advantage and a disadvantage. The advantage is that your portfolio tends to fluctuate less. A disadvantage is if you want to buy and sell frequently. As the volatility of Dividend Aristocrats is lower than that of growth stocks, you may have to wait longer for a price slump.

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.