AB InBev Stock

AB InBev Stock

AB InBev Stock price

Key metrics

| Market capitalization | €113.76b |

| Enterprise Value | €184.91b |

| PER (TTM) P/E ratio | 22.49 |

| EV/FCF (TTM) EV/FCF | 23.18 |

| EV/Sales (TTM) EV/Sales | 3.37 |

| P/S ratio (TTM) P/S ratio | 2.07 |

| P/B ratio (TTM) P/B ratio | 1.49 |

| Dividend yield | 1.47% |

| Last dividend (FY23) | €0.82 |

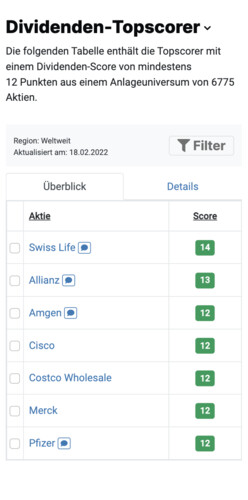

Is AB InBev a Top Scorer Stock based on the Dividend, High-Growth-Investing or Leverman Strategy?

As a Free StocksGuide user, you can view scores for all 6,945 stocks worldwide.

AB InBev Stock Analysis

Analyst Opinions

26 Analysts have issued a AB InBev forecast:

Analyst Opinions

26 Analysts have issued a AB InBev forecast:

Financial data from AB InBev

| Dec '23 | |

| Current assets | 21,153 21,153 |

| Fixed assets | 178,927 178,927 |

| Total Assets | 200,081 200,081 |

| Dec '23 | |

| Equity | 83,896 83,896 |

| Debt capital | 116,184 116,184 |

| Total Capital | 200,081 200,081 |

In millions EUR.

Don't miss a Thing! We will send you all news about AB InBev directly to your mailbox free of charge.

If you wish, we will send you an e-mail every morning with news on stocks of your portfolios.

AB InBev Stock News

Company Profile

Anheuser-Busch InBev SA/NV operates as a holding company, which engages in the manufacture and distribution of alcoholic and non-alcoholic beverages. It operates through the following geographical segments: North America, Latin America West, Latin America North, Latin America South, EMEA, Asia Pacific and Global Export and Holding Companies. The Global Export and Holding Companies segment includes the global headquarters and the export businesses in other countries. Its brands include Budweiser, Corona and Stella Artois; multi-country brands Beck's, Castle, Castle Lite, Hoegaarden and Leffe; and local champions, such as Aguila, Antarctica, Bud Light, Brahma, Cass, Chernigivske, Cristal, Harbin, Jupiler, Klinskoye, Michelob Ultra, Modelo Especial, Quilmes, Victoria, Sedrin, Sibirskaya Korona, and Skol. The company was founded in 2008 and is headquartered in Leuven, Belgium.

| Head office | Belgium |

| CEO | Michel Doukeris |

| Employees | 154,540 |

| Founded | 1977 |

| Website | www.ab-inbev.com |

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.