Asahi Kasei Stock

Asahi Kasei Stock

Asahi Kasei Stock price

Key metrics

| Market capitalization | JPY1.41t |

| Enterprise Value | JPY2.10t |

| P/E (TTM) P/E ratio | 20.71 |

| EV/FCF (TTM) EV/FCF | 12.96 |

| EV/Sales (TTM) EV/Sales | 0.73 |

| P/S ratio (TTM) P/S ratio | 0.49 |

| P/B ratio (TTM) P/B ratio | 0.74 |

| Dividend yield | 3.53% |

| Last dividend (FY25) | JPY36.00 |

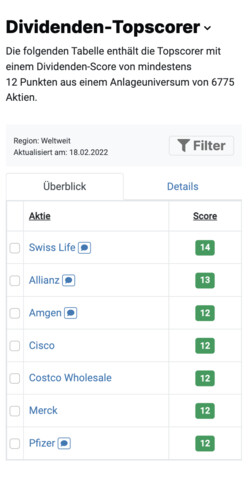

Is Asahi Kasei a Top Scorer Stock based on the Dividend, High-Growth-Investing or Leverman Strategy?

As a Free StocksGuide user, you can view scores for all 6,912 stocks worldwide.

Asahi Kasei Stock Analysis

Analyst Opinions

12 Analysts have issued a Asahi Kasei forecast:

Analyst Opinions

12 Analysts have issued a Asahi Kasei forecast:

Financial data from Asahi Kasei

| Mar '24 |

+/-

%

|

||

| Revenue | 2,784,878 2,784,878 |

2%

2%

|

|

| Gross Profit | 849,213 849,213 |

6%

6%

|

|

| EBITDA | 322,942 322,942 |

6%

6%

|

EBIT (Operating Income) EBIT | 140,746 140,746 |

10%

10%

|

| Net Profit | 43,806 43,806 |

148%

148%

|

|

In millions JPY.

Don't miss a Thing! We will send you all news about Asahi Kasei directly to your mailbox free of charge.

If you wish, we will send you an e-mail every morning with news on stocks of your portfolios.

Company Profile

Asahi Kasei Corp. operates as a holding company which provides monitoring, planning, and strategic management to its subsidiaries and affiliates. Its operations are carried out through the following segments: Materials, Homes, Health Care, and Others. The Materials segment includes caustic soda, chlorine, acrylonitrile, styrene, methyl methacrylate, adipic acid, polyethylene, polystyrene, and other petrochemicals. The Homes segment includes Long Life Home products and also provides remodeling, real estate, and urban redevelopment. The Health Care segment includes pharmaceuticals and diagnostic reagents. The Others segment includes engineering, employment agency and temporary staffing services. The company was founded on May 21, 1931 and is headquartered in Tokyo, Japan.

| Head office | Japan |

| CEO | Koshiro Kudo |

| Employees | 49,295 |

| Founded | 1931 |

| Website | www.asahi-kasei.co.jp |

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.