JD.com ADR Stock

JD.com ADR Stock

JD.com ADR Stock price

Key metrics

| Market capitalization | $36.76b |

| Enterprise Value | $29.04b |

| P/E (TTM) P/E ratio | 9.79 |

| EV/Sales (TTM) EV/Sales | 0.19 |

| P/S ratio (TTM) P/S ratio | 0.24 |

| P/B ratio (TTM) P/B ratio | 1.30 |

| Dividend yield | 2.82% |

| Last dividend (FY24) | $0.76 |

| Revenue growth (TTM) Revenue growth | -0.42% |

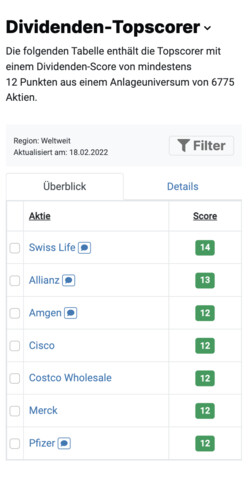

Is JD.com ADR a Top Scorer Stock based on the Dividend, High-Growth-Investing or Leverman Strategy?

As a Free StocksGuide user, you can view scores for all 6,908 stocks worldwide.

JD.com ADR Stock Analysis

Analyst Opinions

46 Analysts have issued a JD.com ADR forecast:

Analyst Opinions

46 Analysts have issued a JD.com ADR forecast:

Financial data from JD.com ADR

| Jun '24 | |

| Current assets | 44,343 44,343 |

| Fixed assets | 45,339 45,339 |

| Total Assets | 89,682 89,682 |

| Jun '24 | |

| Equity | 39,630 39,630 |

| Debt capital | 50,053 50,053 |

| Total Capital | 89,682 89,682 |

In millions USD.

Don't miss a Thing! We will send you all news about JD.com ADR directly to your mailbox free of charge.

If you wish, we will send you an e-mail every morning with news on stocks of your portfolios.

JD.com ADR Stock News

Company Profile

JD.com, Inc. is a technology driven E-commerce company. It engages in the sale of electronics products and general merchandise products, including audio, video products, and books. The company operates through the following business segments: JD Mall, and New Businesses. The JD Mall segment represents its core e-commerce business. The New Businesses segment includes logistic services provided to third parties, technology services, overseas business, insurance and O2O. It also provides an online marketplace, whereby third-party sellers sell products to customers primarily through its websites and mobile apps. The company offers advertising, logistics and other value-added services. JD com was founded on June 18, 1998 by Qiang Dong Liu and is headquartered in Beijing, China.

| Head office | China |

| CEO | Sandy Xu |

| Employees | 517,124 |

| Founded | 1998 |

| Website | www.jd.com |

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.