Moog Inc. Class B Stock

Moog Inc. Class B Stock

Moog Inc. Class B Stock price

Key metrics

| Market capitalization | $5.97b |

| Enterprise Value | $7.03b |

| P/E (TTM) P/E ratio | 29.57 |

| EV/FCF (TTM) EV/FCF | 168.41 |

| EV/Sales (TTM) EV/Sales | 1.97 |

| P/S ratio (TTM) P/S ratio | 1.67 |

| P/B ratio (TTM) P/B ratio | 3.41 |

| Dividend yield | 0.60% |

| Last dividend (FY24) | $1.11 |

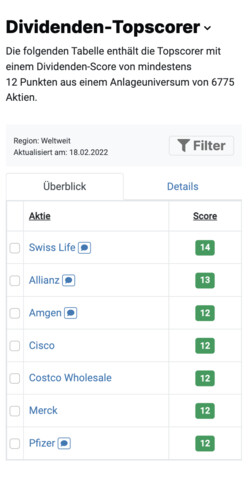

Is Moog Inc. Class B a Top Scorer Stock based on the Dividend, High-Growth-Investing or Leverman Strategy?

As a Free StocksGuide user, you can view scores for all 6,912 stocks worldwide.

Moog Inc. Class B Stock Analysis

Analyst Opinions

4 Analysts have issued a Moog Inc. Class B forecast:

Analyst Opinions

4 Analysts have issued a Moog Inc. Class B forecast:

Financial data from Moog Inc. Class B

| Jun '24 | |

| Current assets | 2,172 2,172 |

| Fixed assets | 1,895 1,895 |

| Total Assets | 4,068 4,068 |

| Jun '24 | |

| Equity | 1,794 1,794 |

| Debt capital | 2,274 2,274 |

| Total Capital | 4,068 4,068 |

In millions USD.

Don't miss a Thing! We will send you all news about Moog Inc. Class B directly to your mailbox free of charge.

If you wish, we will send you an e-mail every morning with news on stocks of your portfolios.

Moog Inc. Class B Stock News

Company Profile

Moog, Inc. is a designer, manufacturer, and systems integrator of precision motion and fluid controls and systems for applications in aerospace and defense and industrial markets. It operates through the following segments: Aircraft Controls; Space and Defense Controls; and Industrial Systems. The Aircraft Controls segment design, manufacture, and integrate primary and secondary flight controls for military and commercial aircraft and provide aftermarket support. The Space and Defense Controls segment involves in controlling satellites, space vehicles, launch vehicles, armored combat vehicles, tactical and strategic missiles, security and surveillance, and other defense applications. The Industrial Systems segment involves in customizing machine performance components and systems utilizing electrohydraulic, electromechanical, and control technologies in applications involving motion control, fluid control, and power and data management across a variety of markets. The company was founded by William C. Moog, Arthur Moog, and Lou Geyer in 1951 and is headquartered in East Aurora, NY.

| Head office | United States |

| CEO | Patrick Roche |

| Employees | 13,500 |

| Founded | 1951 |

| Website | www.moog.com |

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.