Playa Hotels & Resorts N.V. Share price

Key figures

| Market capitalization | $1.12b |

| Enterprise Value | $1.90b |

| PER (TTM) P/E ratio | 17.91 |

| EV/FCF (TTM) EV/FCF | 18.72 |

| EV/Sales (TTM) EV/Sales | 1.89 |

| P/S ratio (TTM) P/S ratio | 1.11 |

| P/B ratio (TTM) P/B ratio | 1.93 |

| Sales growth (TTM) Sales growth | 10.28% |

| Turnover (TTM) Turnover | $1.00b |

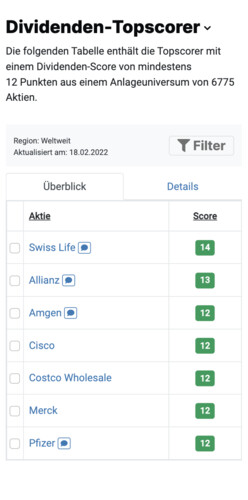

Is Playa Hotels & Resorts N.V. a top scorer stock according to the dividend, high growth investing or Leverman strategy?

As a free StocksGuide basic user, you can view the scores for all 6,953 shares worldwide.

Playa Hotels & Resorts N.V. Share analysis

Analyst opinions

6 Analysts have issued a Playa Hotels & Resorts N.V. forecast:

Analyst opinions

6 Analysts have issued a Playa Hotels & Resorts N.V. forecast:

Financial data from Playa Hotels & Resorts N.V.

| Dec '23 |

+/-

%

|

||

| Turnover | 978 978 |

14%

14%

|

|

| Gross income | 367 367 |

19%

19%

|

|

| EBITDA | 258 258 |

9%

9%

|

EBIT (operating result) EBIT | 176 176 |

11%

11%

|

| Net profit | 54 54 |

5%

5%

|

|

Figures in millions USD.

Don't miss a thing! We will send you all news about the Playa Hotels & Resorts N.V. share directly to your mailbox free of charge.

If you wish, you can receive an e-mail every morning in time for breakfast containing all the stock news relevant to you.

Playa Hotels & Resorts N.V. Share News

Company profile

Playa Hotels & Resorts NV operates hotels and resorts. It engages in the ownership, operation, and development of all-inclusive resorts in beachfront location destinations in Mexico and the Caribbean. The company owns and manages Hyatt Zilara Cancun, Hyatt Ziva Cancun, Panama Jack Resorts Cancun, Panama Jack Resorts Playa del Carmen, Hilton Playa del Carmen an All-Inclusive Resort, Hyatt Ziva Puerto Vallarta, Hyatt Ziva Los Cabos, Hyatt Zilara Rose Hall and Hyatt Ziva Rose Hall, Hilton Rose Hall Resort & Spa, Jewel Dunn's River Beach Resort, Jewel Grande Montego Bay Resort & Spa, Jewel Runaway Bay Beach & Golf Resort, Jewel Paradise Cove Beach Resort & Spa, Hyatt Zilara Cap Cana, Hyatt Ziva Cap Cana Hilton La Romana an All-Inclusive Family Resort and Hilton La Romana an All-Inclusive Adult Resort. The company was founded on March 28, 2013 and is headquartered in Amsterdam, the Netherlands.

| Head office | Netherlands |

| CEO | Bruce Wardinski |

| Employees | 14,100 |

| Founded | 2016 |

| Website | www.playaresorts.com |

Register for free

StocksGuide is the tool for easily finding, analyzing and monitoring shares. Learn from successful investors and make well-founded investment decisions. We make you a self-determined investor.