Wingstop, Inc. Stock

Wingstop, Inc. Stock

Wingstop, Inc. Stock price

Key metrics

| Market capitalization | $12.09b |

| Enterprise Value | $12.73b |

| P/E (TTM) P/E ratio | 128.96 |

| EV/FCF (TTM) EV/FCF | 116.55 |

| EV/Sales (TTM) EV/Sales | 23.32 |

| P/S ratio (TTM) P/S ratio | 22.16 |

| P/B ratio (TTM) P/B ratio | negative |

| Dividend yield | 0.20% |

| Last dividend (FY23) | $0.82 |

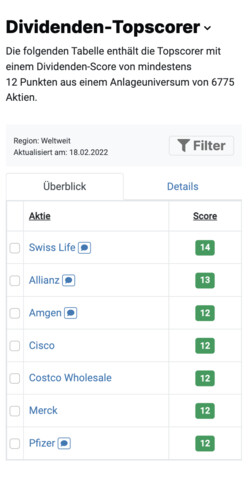

Is Wingstop, Inc. a Top Scorer Stock based on the Dividend, High-Growth-Investing or Leverman Strategy?

As a Free StocksGuide user, you can view scores for all 6,908 stocks worldwide.

Wingstop, Inc. Stock Analysis

Analyst Opinions

24 Analysts have issued a Wingstop, Inc. forecast:

Analyst Opinions

24 Analysts have issued a Wingstop, Inc. forecast:

Financial data from Wingstop, Inc.

| Dec '23 |

+/-

%

|

||

| Net Profit | 70 70 |

33%

33%

|

|

| Depreciation and Amortization | 13 13 |

21%

21%

|

|

| Stock Compensation | 16 16 |

270%

270%

|

|

| Operating Cash Flow | 122 122 |

59%

59%

|

|

| Investments | 41 41 |

71%

71%

|

|

| Dividend Paid | 25 25 |

82%

82%

|

|

| Free Cash Flow | 81 81 |

54%

54%

|

|

In millions USD.

Don't miss a Thing! We will send you all news about Wingstop, Inc. directly to your mailbox free of charge.

If you wish, we will send you an e-mail every morning with news on stocks of your portfolios.

Wingstop, Inc. Stock News

Company Profile

Wingstop, Inc. is a franchisor and operator of restaurants, which engages in the provision of cooked-to-order, hand-sauced, and tossed chicken wings. It operates through Franchise and Company segments. The Franchise segment consists of domestic and international franchise restaurants. The Company segment comprises company-owned restaurants. The company was founded in 1994 and is headquartered in Dallas, TX.

| Head office | United States |

| CEO | Michael Skipworth |

| Employees | 1,225 |

| Founded | 1994 |

| Website | www.wingstop.com |

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.