Williams-Sonoma Dividend history 18 years & forecast 2025 to 2027

Dividend analysis of the Williams-Sonoma share

| Current dividend yield | 5.61 % |

| Dividendenrendite 5 Jahre | 2.26 % |

| Dividend yield 10 years | 4.58 % |

| Payout 3 years | 5.43 % |

When does Williams-Sonoma pay a dividend?

Williams-Sonoma pays the next dividend on Aug 23 2024 (payday). The ex-day is on Jul 19 2024. The Williams-Sonoma share dividend is distributed 4 times a year. In order to receive a dividend, you should generally own the Williams-Sonoma share before the ex-dividend date. The dividend calendar shows that the last ex-day dates were January, April, July and October . Dividends from Williams-Sonoma are distributed via February, May, August and November.

| Year | Dividend | Ex-day & Payday |

Frequency | |

|---|---|---|---|---|

| Financial year | Dividend per share | Ex-Day | Payday | Payment frequency |

| 2025 |

$0.57

Forecast

$0.57

Forecast

|

Jul 19 2024

Jul 19 2024

Aug 23 2024

Jul 19 24

Aug 23 24 |

Aug 23 2024 |

quarterly

quarterly

|

| 2025 |

$1.13

$1.13

|

Apr 18 2024

Apr 18 2024

May 24 2024

Apr 18 24

May 24 24 |

May 24 2024 |

quarterly

quarterly

|

| 2024 |

$0.9

$0.9

|

Jan 18 2024

Jan 18 2024

Feb 23 2024

Jan 18 24

Feb 23 24 |

Feb 23 2024 |

quarterly

quarterly

|

| 2024 |

$0.9

$0.9

|

Oct 19 2023

Oct 19 2023

Nov 24 2023

Oct 19 23

Nov 24 23 |

Nov 24 2023 |

quarterly

quarterly

|

| 2024 |

$0.9

$0.9

|

Jul 20 2023

Jul 20 2023

Aug 25 2023

Jul 20 23

Aug 25 23 |

Aug 25 2023 |

quarterly

quarterly

|

| 2024 |

$0.9

$0.9

|

Apr 20 2023

Apr 20 2023

May 26 2023

Apr 20 23

May 26 23 |

May 26 2023 |

quarterly

quarterly

|

| 2023 |

$0.78

$0.78

|

Jan 19 2023

Jan 19 2023

Feb 24 2023

Jan 19 23

Feb 24 23 |

Feb 24 2023 |

quarterly

quarterly

|

| 2023 |

$0.78

$0.78

|

Oct 20 2022

Oct 20 2022

Nov 25 2022

Oct 20 22

Nov 25 22 |

Nov 25 2022 |

quarterly

quarterly

|

| 2023 |

$0.78

$0.78

|

Jul 21 2022

Jul 21 2022

Aug 26 2022

Jul 21 22

Aug 26 22 |

Aug 26 2022 |

quarterly

quarterly

|

| 2023 |

$0.78

$0.78

|

Apr 21 2022

Apr 21 2022

May 27 2022

Apr 21 22

May 27 22 |

May 27 2022 |

quarterly

quarterly

|

How much dividend does Williams-Sonoma pay?

Williams-Sonoma most recently paid a dividend of $1.13. Williams-Sonoma paid a dividend of $3.60 per share in the financial year 2024. With a share price of $294.47 at Jun 25 2024, the current dividend yield is 1.22% (calculation: $3.60 / $294.47 = 1.22%). No special dividend was paid.

What is the Williams-Sonoma dividend yield and payout ratio?

The average Williams-Sonoma dividend yield over the last 5 years is 2.23% and the average over the last 10 years is 2.31%.

The payout ratio of Williams-Sonoma in relation to the last financial year is 24.74%. The payout ratio smoothed over 3 years is 20.43%. The calculation is based on the sum of all dividend payments divided by the cumulative earnings per share(EPS).

| Key figure | Williams-Sonoma |

|---|---|

| Current dividend yield | 1.22% |

| Dividend yield 5 yrs. | 2.23% |

| Dividend yield 10 yrs. | 2.31% |

| Payout 1 yr. | 24.74% |

| Payout 3 yrs. | 20.43% |

Is the Williams-Sonoma dividend safe? Continuity & dividend growth

Is the Williams-Sonoma dividend safe?

Williams-Sonoma has been paying a dividend for 18 years and has not lowered the dividend for 18 years (dividend continuity). As a result, the dividend was recently increased14-times.

The dividend growth in relation to the previous financial year amounts to 15.38%. The average Williams-Sonoma dividend growth over the last 5 years is 15.92%. The average for the last 10 years is 11.25%.

| Key figure | Williams-Sonoma |

|---|---|

| Increased | 14 Years |

| Continuity | 18 Years |

| Paid | 18 Years |

| Growth 1 yr. | 15.38% |

| Growth 5 yrs. | 15.92% |

| Growth 10 yrs. | 11.25% |

Continuity

Williams-Sonoma has been paying a dividend for 18 years and has not lowered the dividend for 18 years (dividend continuity). As a result, the dividend was recently increased14-times.

Dividend growth

The dividend growth in relation to the previous financial year amounts to 15.38%. The average Williams-Sonoma dividend growth over the last 5 years is 15.92%. The average for the last 10 years is 11.25%.

Williams-Sonoma Share forecast 2024

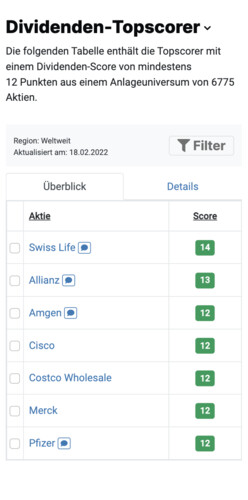

On the stock exchange, the Williams-Sonoma share (ISIN: US9699041011) is not traded as a top scorer in June 2024 according to the dividend strategy.

The share price of Williams-Sonoma 47.04% has risen since the beginning of the year 2024. However, the return generated in the past says nothing about the future return. You can find the Williams-Sonoma share price in real time at the top of the page.

The Williams-Sonoma share (symbol: WSM) is valued at a price/earnings ratio (P/E ratio) of 18.21 and a price/sales ratio (P/S ratio) of 2.49 valued. Based on analyst estimates, the Williams-Sonoma share forecast 2024 of the current financial year corresponds to a valuation of 17.94 according to P/E ratio and 2.46 according to P/S ratioe.

| Key figure | Williams-Sonoma |

|---|---|

| Dividend score | ??/15 |

| Performance 2024 |

47.04%

|

| P/E ratio TTM | 18.21 |

| P/S ratio TTM | 2.49 |

| P/E ratio expected | 17.94 |

| P/S ratio expected | 2.46 |

The Williams-Sonoma share (symbol: WSM) is valued at a price/earnings ratio (P/E ratio) of 18.21 and a price/sales ratio (P/S ratio) of 2.49 valued. Based on analyst estimates, the Williams-Sonoma share forecast 2024 of the current financial year corresponds to a valuation of 17.94 according to P/E ratio and 2.46 according to P/S ratioe.

Discover more dividend stocks

Register for free

StocksGuide is the tool for easily finding, analyzing and monitoring shares. Learn from successful investors and make well-founded investment decisions. We make you a self-determined investor.