ATX Index Chart and Performance

ATX Stocks current & realtime: List Of Companies

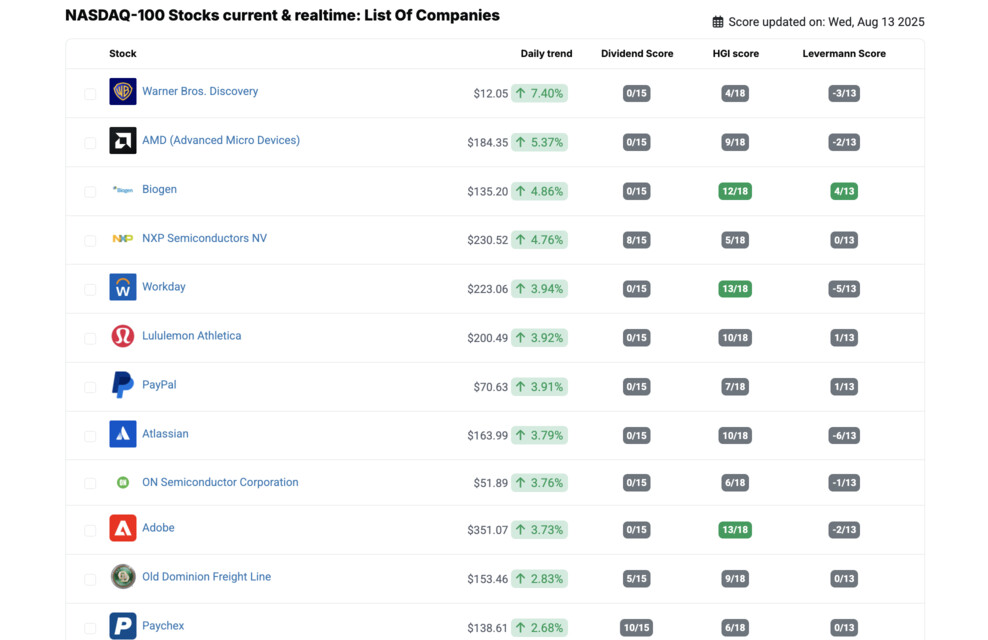

| Stock | Daily trend | Dividend Score | HGI Score | Levermann Score |

|---|

Is a ATX forecast for today, tomorrow, next week or 2026 useful?

A short and medium-term ATX forecast should always be treated with great caution. This is because the ATX index performance today, tomorrow, next week or 2026 depends to a large extent on the sometimes sudden changes in the political or economic news situation or market conditions. Therefore, no one can say with certainty how an index or ATX will develop in the future. Instead of relying on index forecasts, investors should consider analysts' estimates and recommendations for individual stocks. Find out more ➜

The 4 companies at ATX with the highest target price potential according to analysts' estimates.

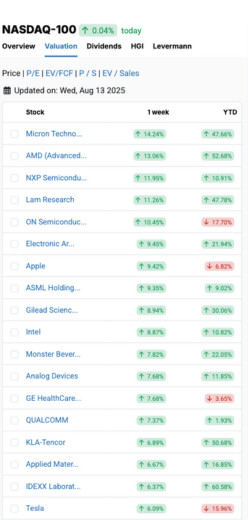

ATX Financials and key metrics

You can analyze the ATX financials of the individual stocks on the Valuation tab. There you will find all information on stock performance, valuations of ATX individual stocks (P/E, EV/FCF, P/S & EV/Sales) and analyses according to the Dividends, High-Growth-Investing and Levermann Strategy.

ATX Market Capitalization Table 2026

The ATX list by market capitalization 2026 shows the weighting by market capitalization from the previous day. The largest company of ATX is currently the Erste Group Bank stock, the second largest is OMV and the smallest company is the Schoeller Bleckmann stock.

If you sort ATX according to enterprise value, the list may look different in some cases. The three largest companies by enterprise value are Erste Group Bank, Raiffeisen and BAWAG Group.

| Top 3 | Marktkap. |

|---|---|

| Erste Group Bank | €41b |

| OMV | €15b |

| Raiffeisen | €12b |

ATX Dividends 2026

In 2026, ATX 2 companies have have paid a dividend so far. The companies with the highest dividend yield at ATX are currently OMV, Schoeller Bleckmann and Oesterreichische Post. The highest dividend growth compared to the previous year was recorded by Do & Co, CA Immobilien and PORR. The minimum requirement is 5 dividend payments in a row without a cut.

| Stock | Div. Score | Market Cap. | Always increased | Never lowered | Always paid | Growth 1Y |

Growth 5Y |

Growth 10Y |

Div. Yield current Current Dividend Yield |

Div. return 5Y Dividend Yield 5Y |

Payout 3Y |

|---|