Kojamo Share

Kojamo Share

Kojamo Share price

Key metrics

| Market capitalization | €2.39b |

| Enterprise Value | €5.95b |

| PER (TTM) P/E ratio | negative |

| EV/FCF (TTM) EV/FCF | 37.70 |

| EV/Sales (TTM) EV/Sales | 13.18 |

| P/S ratio (TTM) P/S ratio | 5.31 |

| P/B ratio (TTM) P/B ratio | 0.65 |

| Dividend yield | 4.03% |

| Last dividend (FY22) | €0.39 |

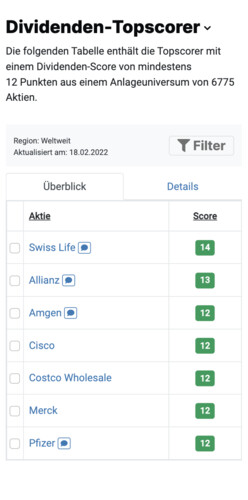

Is Kojamo a top scorer stock according to the dividend, high growth investing or Leverman strategy?

As a free StocksGuide basic user, you can view the scores for all 6,954 shares worldwide.

Kojamo Share analysis

Analyst opinions

9 Analysts have issued a Kojamo forecast:

Analyst opinions

9 Analysts have issued a Kojamo forecast:

Financial data from Kojamo

| Mar '24 | |

| Current assets | - - |

| Fixed assets | - - |

| Total assets | 8,275 8,275 |

| Mar '24 | |

| Equity | 3,664 3,664 |

| Debt capital | 4,611 4,611 |

| Total capital | 8,275 8,275 |

Figures in millions EUR.

Don't miss a thing! We will send you all news about the Kojamo share directly to your mailbox free of charge.

If you wish, you can receive an e-mail every morning in time for breakfast containing all the stock news relevant to you.

Company profile

Kojamo Oyj provides real estate services. The firm offers the possible services for renting and housing. It also provides rental apartments and residents with housing services for different life situations. The company operates through two segments Lumo and VVO. Lumo segment offers the commercial housing services. The VVO segment offers the non-commercial housing services. Kojamo was founded in 1969 and is headquartered in Helsinki, Finland.

| Head office | Finland |

| CEO | Jani Nieminen |

| Employees | 288 |

| Founded | 1969 |

| Website | www.kojamo.fi |

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.