STOXX Europe 600 Index Chart and Performance

STOXX Europe 600 Stocks current & realtime: List Of Companies

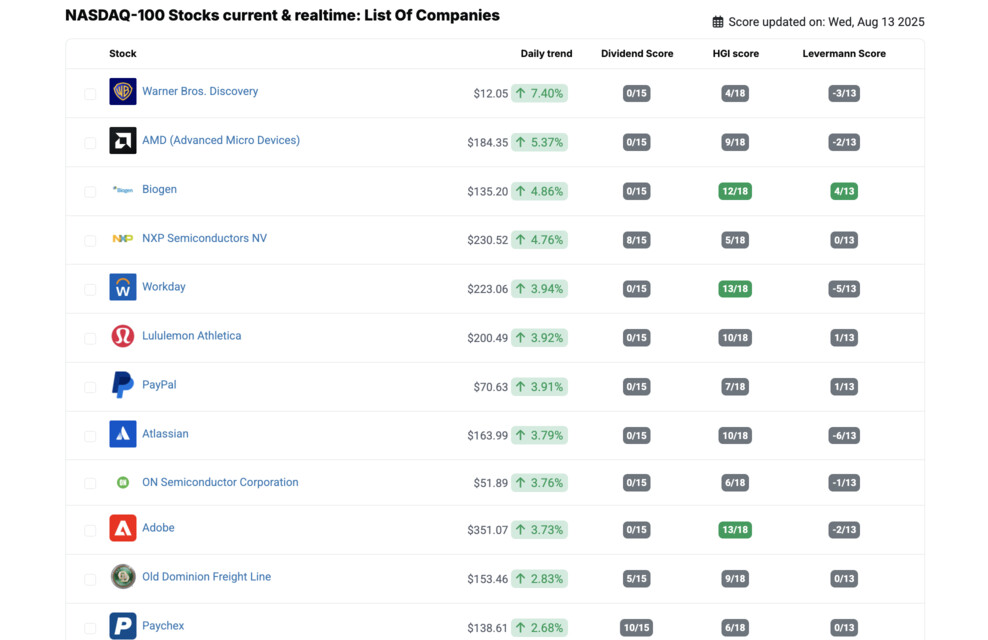

| Stock | Daily trend | Dividend Score | HGI Score | Levermann Score |

|---|

Is a STOXX Europe 600 forecast for today, tomorrow, next week or 2026 useful?

A short and medium-term STOXX Europe 600 forecast should always be treated with great caution. This is because the STOXX Europe 600 index performance today, tomorrow, next week or 2026 depends to a large extent on the sometimes sudden changes in the political or economic news situation or market conditions. Therefore, no one can say with certainty how an index or STOXX Europe 600 will develop in the future. Instead of relying on index forecasts, investors should consider analysts' estimates and recommendations for individual stocks. Find out more ➜

The 4 companies at STOXX Europe 600 with the highest target price potential according to analysts' estimates.

STOXX Europe 600 Financials and key metrics

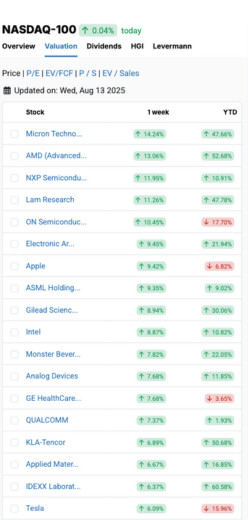

- STOXX Europe 600 Single Stock Valuation

- STOXX Europe 600 according to P/E

- STOXX Europe 600 Dividend Analysis

You can analyze the STOXX Europe 600 financials of the individual stocks on the Valuation tab. There you will find all information on stock performance, valuations of STOXX Europe 600 individual stocks (P/E, EV/FCF, P/S & EV/Sales) and analyses according to the Dividends, High-Growth-Investing and Levermann Strategy.

STOXX Europe 600 Market Capitalization Table 2026

The STOXX Europe 600 list by market capitalization 2026 shows the weighting by market capitalization from the previous day. The largest company of STOXX Europe 600 is currently the Intercontinental Hotels Group stock, the second largest is ASML and the smallest company is the Wise Group stock.

If you sort STOXX Europe 600 according to enterprise value, the list may look different in some cases. The three largest companies by enterprise value are Intercontinental Hotels Group, HSBC and Banco Santander.

| Top 3 | Marktkap. |

|---|---|

| Intercontinental Hotels Group | €2t |

| ASML | €352b |

| LVMH Moet Hennessy Louis Vuitton | €321b |

STOXX Europe 600 Dividends 2026

In 2026, STOXX Europe 600 40 companies have have paid a dividend so far. The companies with the highest dividend yield at STOXX Europe 600 are currently Primary Health Properties, Icade and Proximus. The highest dividend growth compared to the previous year was recorded by Fresnillo, Banco Sabadell and Adidas. The minimum requirement is 5 dividend payments in a row without a cut.

| Stock | Div. Score | Market Cap. | Always increased | Never lowered | Always paid | Growth 1Y |

Growth 5Y |

Growth 10Y |

Div. Yield current Current Dividend Yield |

Div. return 5Y Dividend Yield 5Y |

Payout 3Y |

|---|