Sonoco Products Company Share price

Key metrics

| Market capitalization | $4.84b |

| Enterprise Value | $8.10b |

| PER (TTM) P/E ratio | 12.46 |

| EV/FCF (TTM) EV/FCF | 13.85 |

| EV/Sales (TTM) EV/Sales | 1.21 |

| P/S ratio (TTM) P/S ratio | 0.73 |

| P/B ratio (TTM) P/B ratio | 2.00 |

| Dividend yield | 4.10% |

| Last dividend (FY23) | $2.02 |

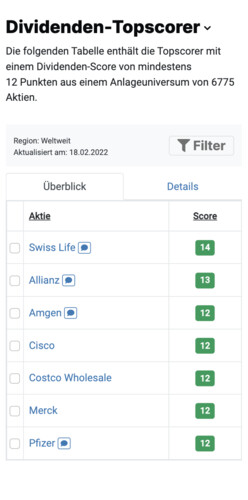

Is Sonoco Products Company a top scorer stock according to the dividend, high growth investing or Leverman strategy?

As a free StocksGuide basic user, you can view the scores for all 6,954 shares worldwide.

Sonoco Products Company Share analysis

Analyst opinions

9 Analysts have issued a Sonoco Products Company forecast:

Analyst opinions

9 Analysts have issued a Sonoco Products Company forecast:

Financial data from Sonoco Products Company

| Dec '23 |

+/-

%

|

||

| Turnover | 6,770 6,770 |

7%

7%

|

|

| Gross income | 1,448 1,448 |

3%

3%

|

|

| EBITDA | 1,081 1,081 |

5%

5%

|

EBIT (operating result) EBIT | 740 740 |

10%

10%

|

| Net profit | 475 475 |

2%

2%

|

|

Figures in millions USD.

Don't miss a thing! We will send you all news about the Sonoco Products Company share directly to your mailbox free of charge.

If you wish, you can receive an e-mail every morning in time for breakfast containing all the stock news relevant to you.

Sonoco Products Company Share News

Company profile

Sonoco Products Co. engages in the manufacture of industrial and consumer packaging products and services. It operates through the following segments: Consumer Packaging, Display and Packaging, Paper and Industrial Converted Products, Protective Solutions, and Corporate. The Consumer Packaging segment offers round and shaped rigid containers and trays; extruded and injection-molded plastic products; printed flexible packaging; global brand artwork management; and metal and peelable membrane ends and closures. The Display and Packaging segment consists designing, manufacturing, assembling, packing, and distributing temporary, semi-permanent, and permanent point-of-purchase displays; supply chain management services; retail packaging; and paper amenities. The Paper and Industrial Converted Products segment comprises paperboard tubes, cones, and cores; fiber-based construction tubes; wooden, metal, and composite wire and cable reels and spools; and recycled paperboard, linerboard, corrugating medium, recovered paper, and material recycling services. The Protective Solutions segment provides custom-engineered, paperboard-based and expanded foam protective packaging and components; temperature-assured packaging. The Corporates segment covers restructuring charges, asset impairment charges, gains from the disposition of businesses, insurance settlement gains, acquisition-related costs, non-operating pension costs, interest expense, and interest income. The company was founded on May 10, 1899 and is headquartered at Hartsville, SC.

| Head office | United States |

| CEO | Robert Coker |

| Employees | 23,000 |

| Founded | 1899 |

| Website | www.sonoco.com |

Register for Free

StocksGuide is the ultimate tool for easily finding, analyzing and tracking stocks. Learn from successful investors and make informed investment decisions. We empower you to become a confident, independent investor.